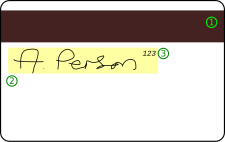

An example of the front of a typical debit card:

- Issuing bank logo

- EMV chip

- Hologram

- Card number

- Card brand logo

- Expiration date

- Cardholder's name

Although many debit cards are of the Visa or MasterCard brand, there are many other types of debit card, each accepted only within a particular country or region, for example Switch (now: Maestro) and Solo in the United Kingdom, Interac in Canada, Carte Bleue in France, Laser in Ireland, "EC electronic cash" (formerly Eurocheque) in Germany, UnionPay in China and EFTPOS cards in Australia and New Zealand. The need for cross-border compatibility and the advent of the euro recently led to many of these card networks (such as Switzerland's "EC direkt", Austria's "Bankomatkasse" and Switch in the United Kingdom) being re-branded with the internationally recognised Maestro logo, which is part of the MasterCard brand. Some debit cards are dual branded with the logo of the (former) national card as well as Maestro (for example, EC cards in Germany, Laser cards in Ireland, Switch and Solo in the UK, Pinpas cards in the Netherlands, Bancontact cards in Belgium, etc.). The use of a debit card system allows operators to package their product more effectively while monitoring customer spending. An example of one of these systems is ECS by Embed International.

0 comments:

Post a Comment